Pay Loan

Pay Loan refers to the process of repaying an approved loan through scheduled installments.

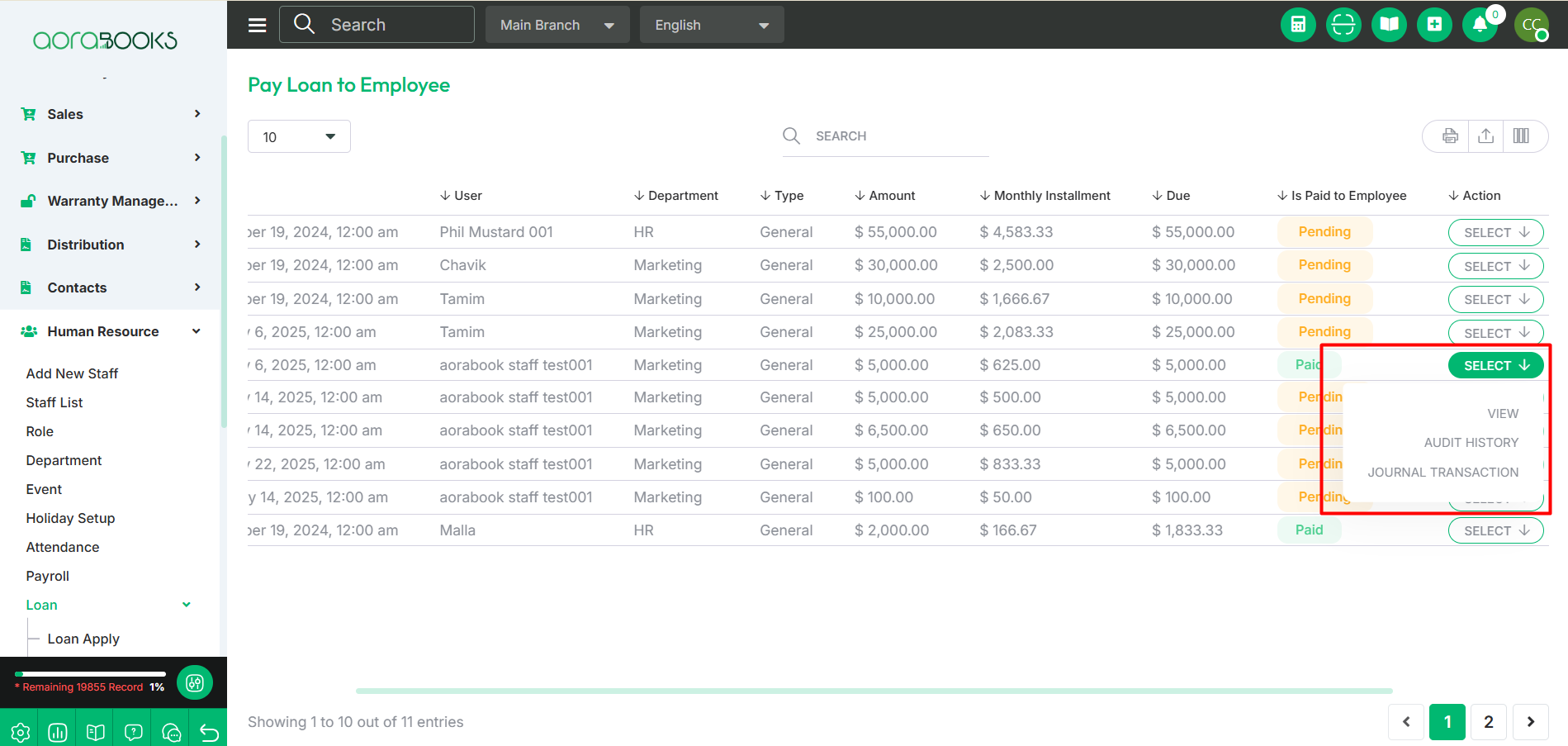

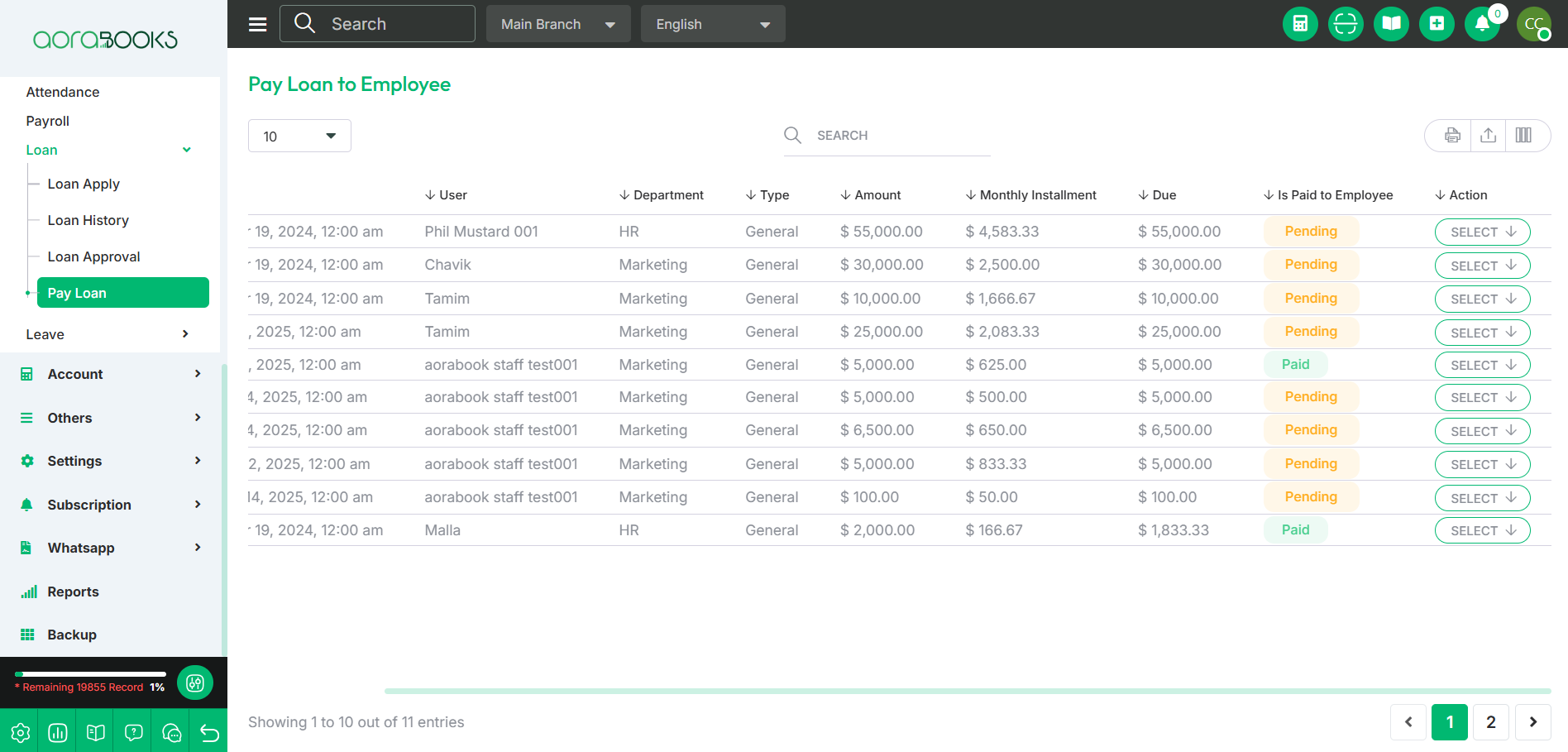

From here, you can view the details of the pay loan list, including:

Date: The date when the loan was applied.

User: The name of the employee who took the loan.

Department: The department of the employee.

Type: The type of loan taken.

Amount: The total loan amount.

Monthly Installment: The installment amount to be paid each month.

Due: The remaining loan balance.

Is Paid to Employee: The status of the loan, whether it is pending or paid.

Action: Perform various actions related to loan repayment.

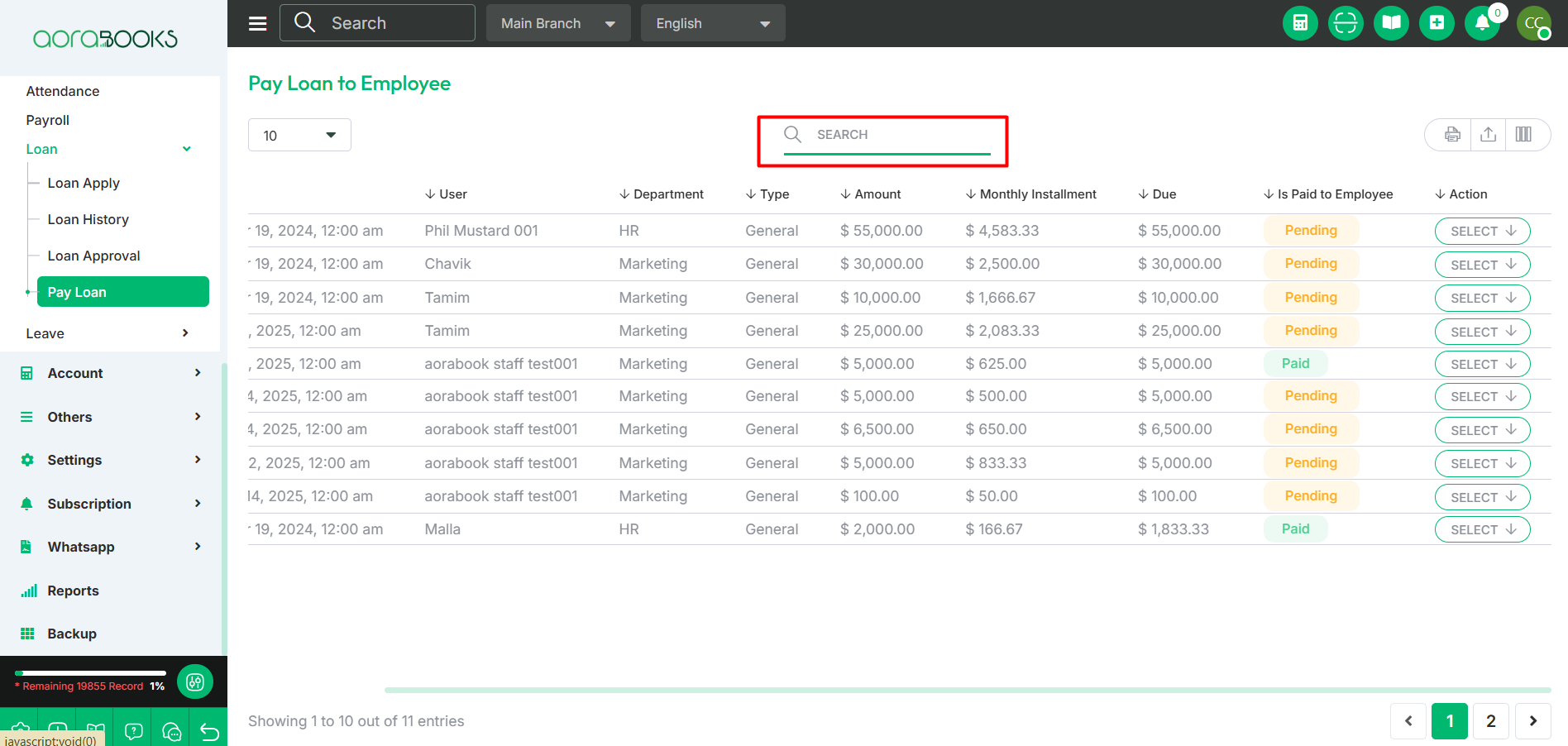

Search: You can find any specific pay loan from the list by using the search functionality.

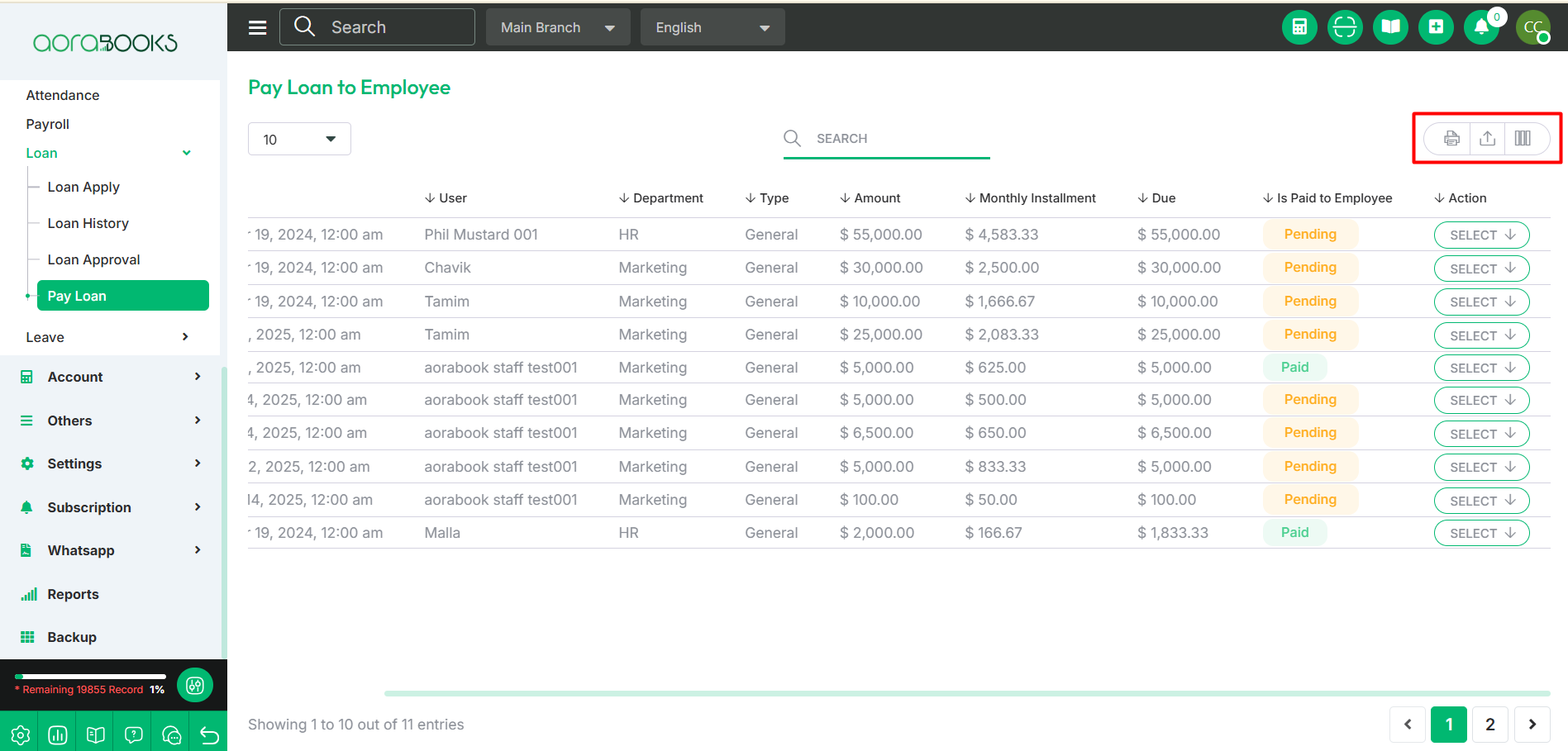

Export Data: You can export the data table from here.

By clicking the select button, if your is paid to employee status is Pending, you can perform the following actions:

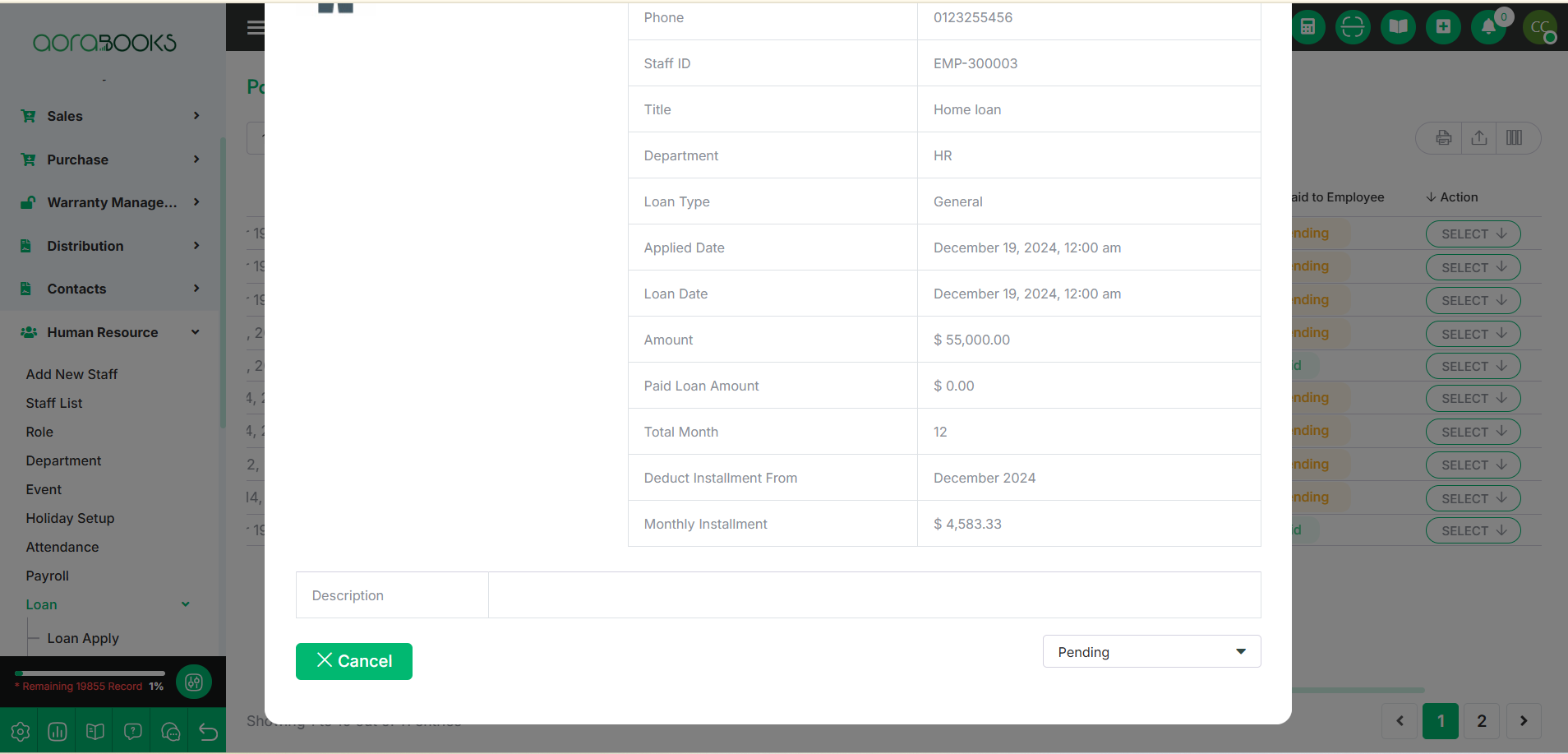

View: You can view the details of the loan request. To approve the loan request, click on the View button.

Approve: After clicking View, a modal will appear. Scroll down in the modal and select Approved from the dropdown to approve the loan.

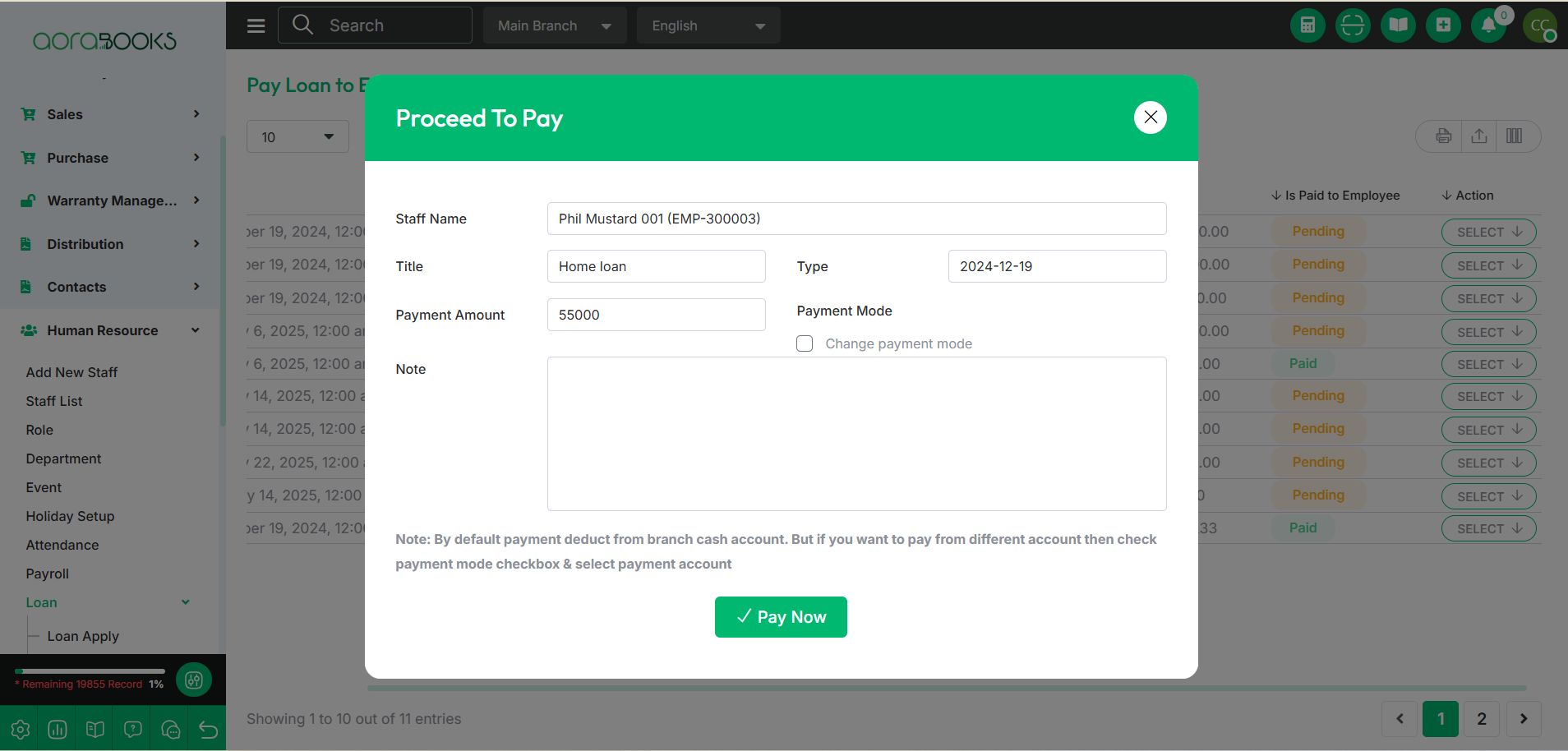

Pay To Employee: If an employee repays a loan amount, you can record the payment from here. To note any installment, just follow the steps below:

Staff Name: Select the employee making the payment.

Title: Enter the loan title.

Type: Choose the loan type.

Payment Amount: Enter the amount being paid.

Change Payment Mode: Select the payment method.

Select Payment From Account: Choose the account from which the payment is made.

Note: Add any relevant notes regarding the payment.

Pay Now: Click to process and record the payment.

By clicking the select button, if your is paid to employee status is approved, you can perform the following actions:

View: You can view the details of the loan.

Journal Transaction: You can view or manage the journal transactions related to the loan.

Audit History: You can view the audit history of the loan, including changes and updates made over time.