12th Mar, 2025

Product Tax

Product tax is the tax applied to a product based on its category. It is calculated using the product's HSN code.

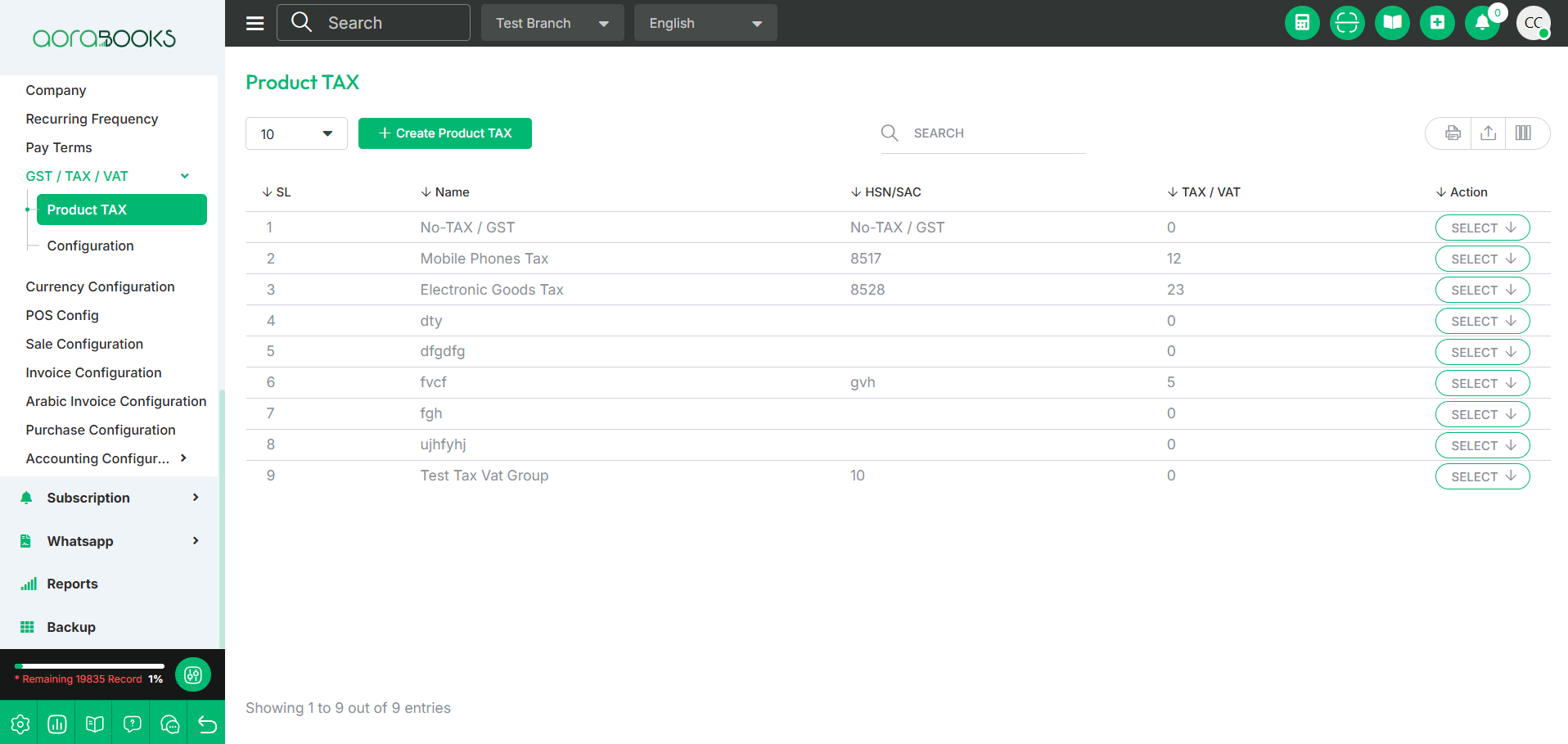

From here, you can view all product taxes with details such as:

Name: The name of the product tax.

HSN/SAC: The HSN/SAC code associated with the product.

Tax/VAT: The applicable tax or VAT percentage.

Action: Click to perform multiple actions like edit or delete.

By clicking the select button, you can perform multiple actions, such as:

Edit: Modify the product tax details.

View: View the detailed information of the product tax.

Delete: Remove the product tax from the list.

Search: You can find out any specific product tax from the list by using the search functionality.

Export Data: By clicking this you can export the data table.

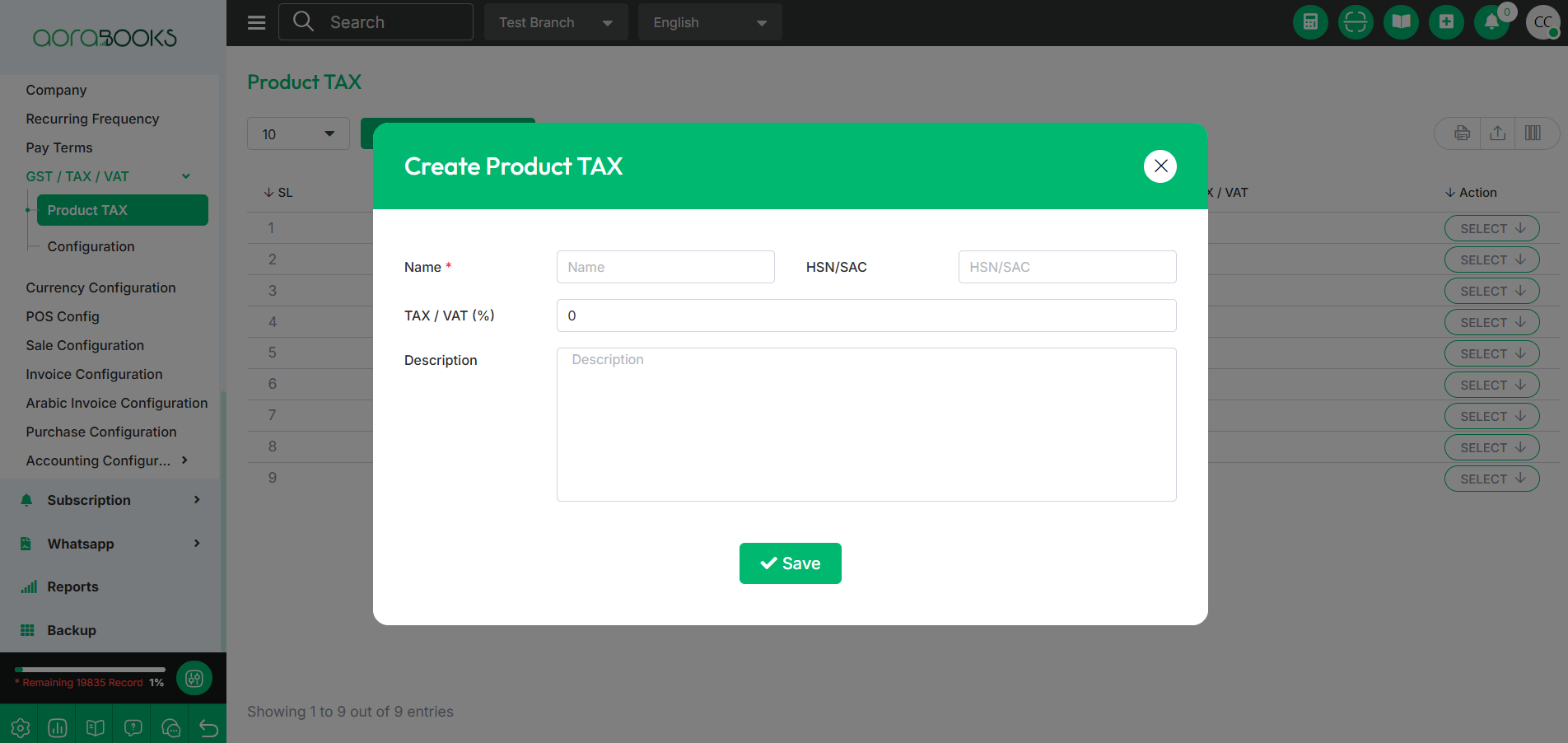

Create Product Tax: By clicking the button, you can add a new product tax. Follow these steps:

Name: Set the name of the product tax.

HSN/SAC: Enter the HSN/SAC code.

Tax/VAT: Define the tax/VAT percentage.

Description: Provide a brief description of the product tax.

Save: Click the button to save the tax details.