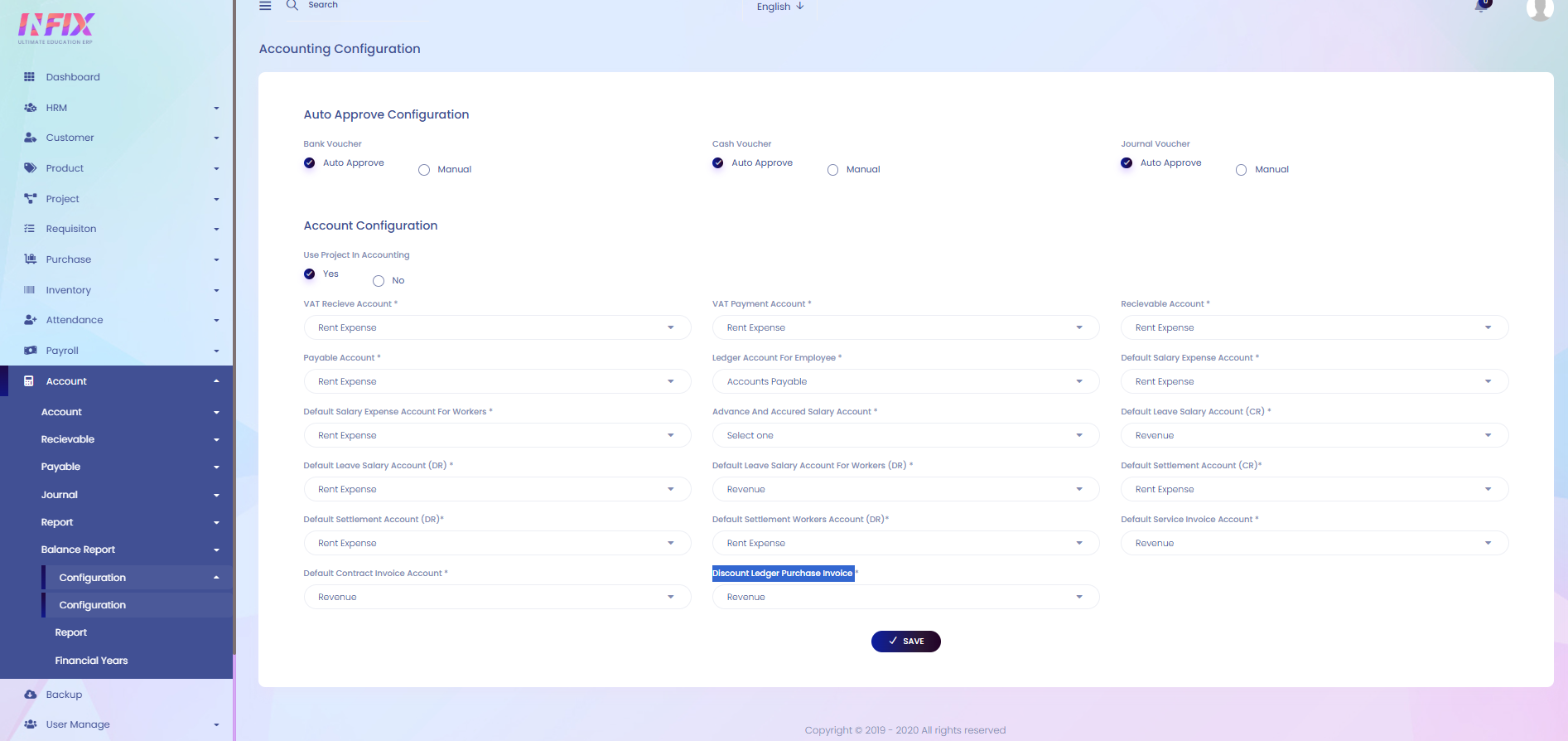

Accounting Configuration

From here you can configure the accounting configuration. To configure follow the below steps:

Auto Approve Configuration: From here you can configure the auto approve. Such as:

Bank Voucher: You can set if the bank voucher will be approved auto or not.

Cash Voucher: You can set if the cash voucher will be approved auto or not.

Journal Voucher: You can set if the journal voucher will be approved auto or not.

Accounting Configuration: From here you can configure the accounting. Such as::

Use Project in Accounting: Set whether projects will be included in accounting.

VAT Receive Account: Select the account for VAT received.

VAT Payment Account: Select the account for VAT payments.

Receivable Account: Define the account to track receivables.

Payable Account: Define the account to track payables.

Ledger Account for Employee: Assign the ledger account for employee-related transactions.

Default Salary Expense Account: Set the default account for salary expenses.

Default Salary Expense Account for Workers: Set the default account for workers’ salary expenses.

Advance and Accrued Salary Account: Specify the account for advance and accrued salaries.

Default Leave Salary Account (CR): Set the credit account for leave salary.

Default Leave Salary Account (DR): Set the debit account for leave salary.

Default Leave Salary Account for Workers (DR): Set the debit account for workers’ leave salary.

Default Settlement Account (CR): Set the credit account for settlements.

Default Settlement Account (DR): Set the debit account for settlements.

Default Settlement Workers Account (DR): Set the debit account for workers’ settlements.

Default Service Invoice Account: Assign the account for service invoices.

Default Contract Invoice Account: Assign the account for contract invoices.

Discount Ledger Purchase Invoice: Select the account for purchase invoice discounts.

Save: Click to save the configuration.