Operating expenses are indirect costs associated with doing business. These differ from the cost of goods sold because they’re not directly associated with the process of producing or distributing products or services. It helps eCommerce businesses visualize their performance. But additionally, it also shows you the variables that lead to such outcomes so that you can change them.

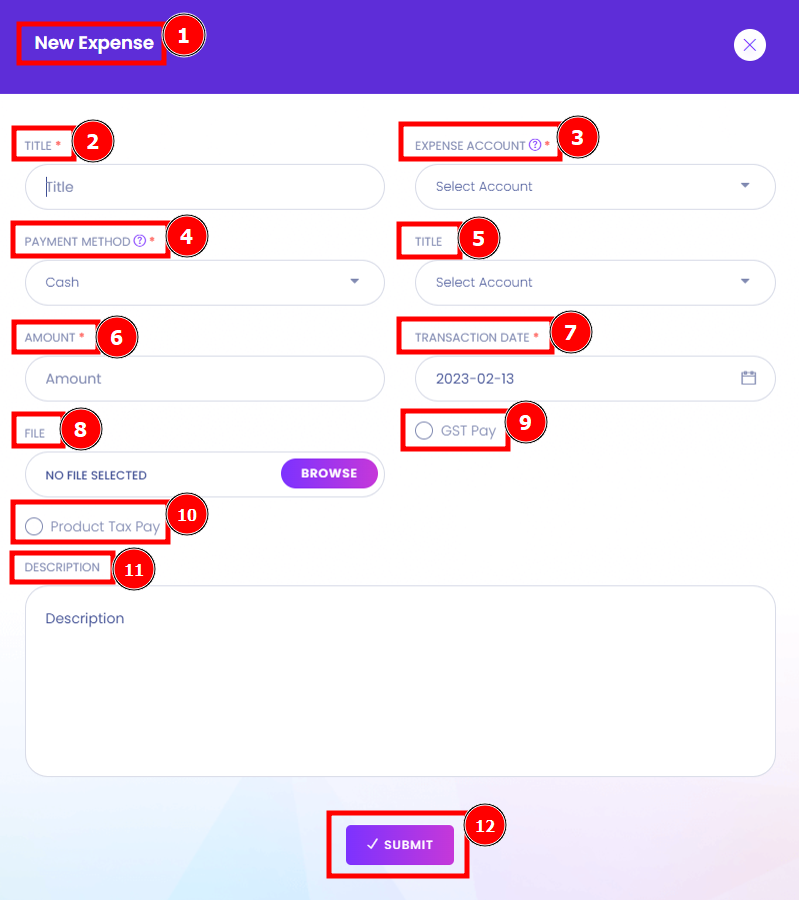

Short Direction: {AmazCart> Dashboard> Expenses> New Expense> SL> Title> Expense Account> Payment Method> Amount> Date> Action.}

Expenses data Analysis is a process of inspecting, cleansing, transforming, and modelling data with the goal of discovering useful information, suggesting conclusions, and supporting decision-making. Data analytics allow us to make informed decisions and to stop.

1- Expenses

2- New Expense

3- SL

4- Title

5- Expense Account

6- Payment Method

7- Amount

8- Date

9- Action

Create New Expenses:

You might know that the five high-level categories for your financial transactions are assets, liabilities, shareholder’s equity, revenue and expenses. However, within expenses, it’s useful to have sub-categories. You can set up these as sub-accounts when setting up your e-commerce chart of accounts in your accounting software. Across all industries website costs to acquire, design, maintain and market your site are common business expenses.

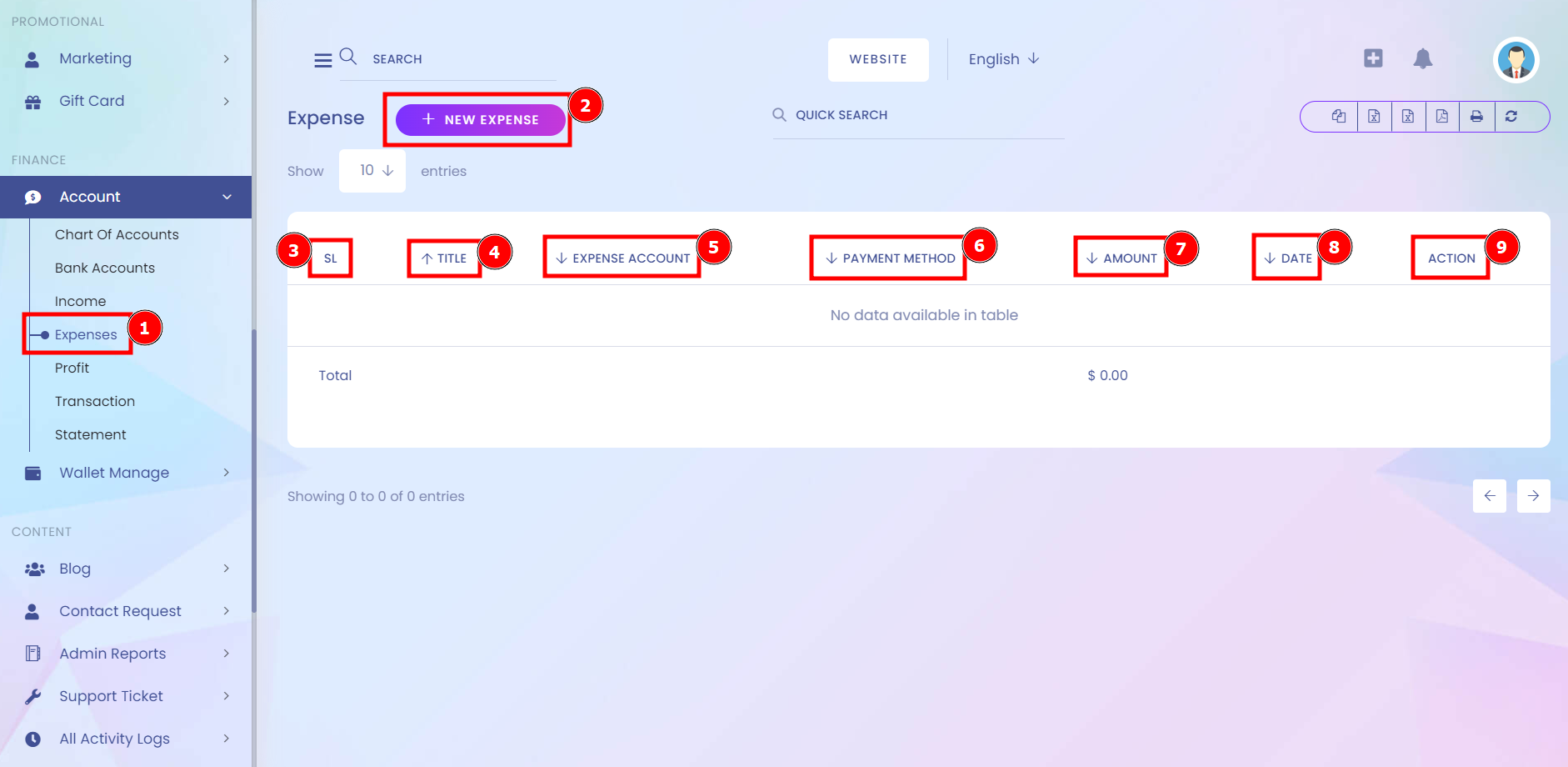

Short Direction: {AmazCart> Dashboard> Expenses> New Expense> Title> Expense Account> Payment Method> Title> Amount> Transaction Date> Uploaded File> GST Pay> Product Tax Pay> Description> Submit.}

Expenses Accounting data can keep marketing focused on cost-effective campaigns that demonstrate a positive ROI(Return on investment). The New Expense accountability can also help in determining the best timing for a particular marketing spend and ensures that marketing expenditures are appropriate and within budget.

1- New Expense

2- Title

3- Expense Account

4- Payment Method

5- Title

6- Amount

7- Transaction Date

8- Uploaded File

9- GST Pay

10- Product Tax Pay

11- Description

12- Submit.