The income list is one of the most important financial statements because it details a company’s income and expenses over a specific period. This document communicates a wealth of information to those reading it—from key executives and stakeholders to investors and employees. Being able to read an income statement is important, but knowing how to generate one is just as critical. The components of the income statement include revenue; cost of sales; sales, general, and administrative expenses; other operating expenses; non-operating income and expenses; gains and losses; non-recurring items; net income; and EPS(Employment Permit System).

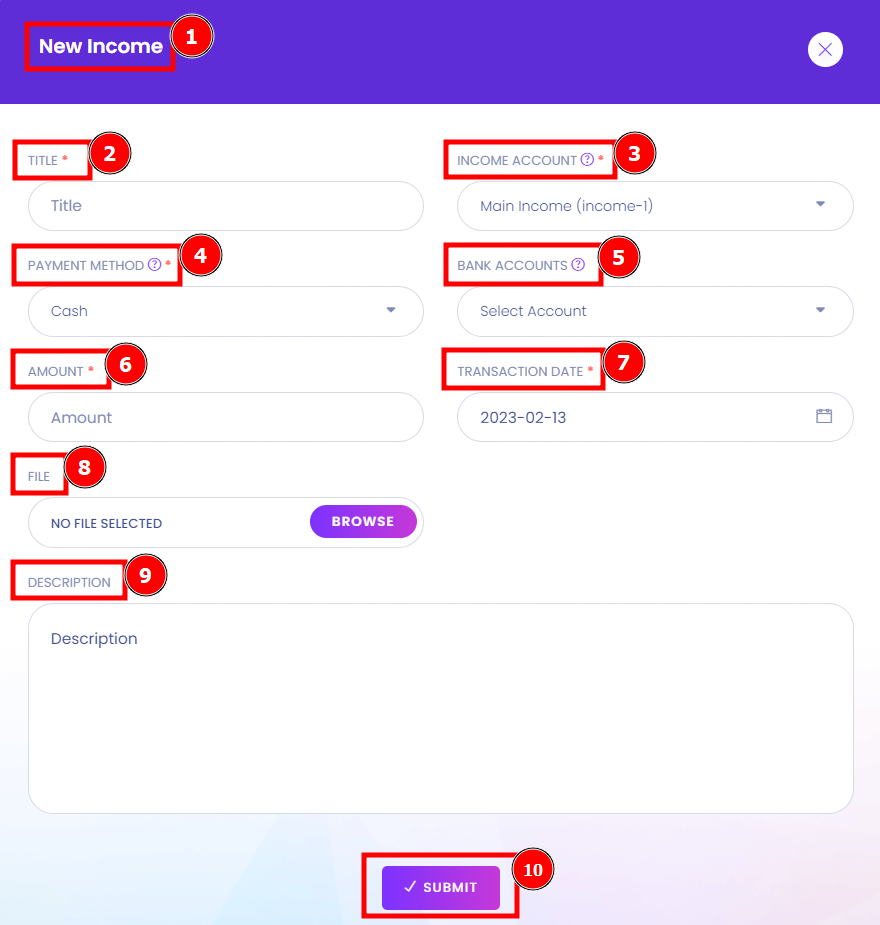

Short Direction: {AmazCart> Dashboard> Income> New Income> SL> Title> Income Account> Payment Method> Amount> Data> Action.}

Its Income interface shows the communicates of how much revenue the company generated during a period and what costs it incurred in connection with generating that revenue. A company’s net income and its components from below here. Using income data analytics can help a marketing team measure the effectiveness of their digital campaigns. The goal of most marketing campaigns for e-commerce businesses is to attract customers to the online store and encourage them to purchase goods or services.

1- Income

2- New Income

3- SL

4- Title

5- Income Account

6- Payment Method

7- Amount

8- Data

9- Action for Edit or Delete.

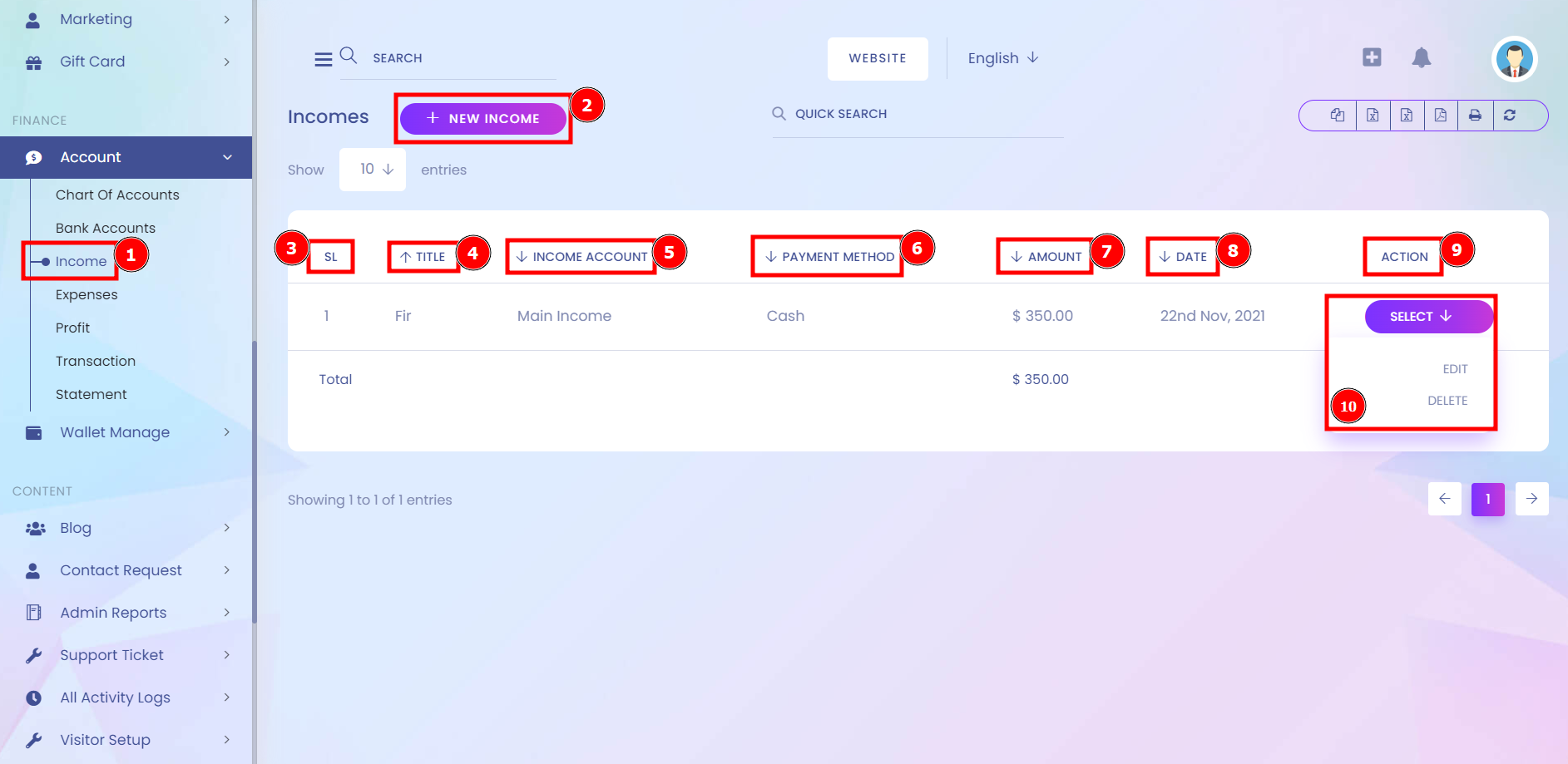

Add New Income:

Investment analysts intensely scrutinize companies’ income statements. Equity analysts are interested in them because equity markets often reward relatively high- or low-earnings growth companies with above-average or below-average valuations, respectively, and because inputs into valuation models often include estimates of earnings. Fixed-income analysts On use by AmazCard dashboard income extension.

Short Direction: {AmazCart> Dashboard> Income> New Income> Title> Income Account> Payment Method> Bank Account> Amount> Transaction Date> Upload File> Description> Submit.}

Although the income report is typically generated by a member of the accounting department at large organizations, knowing how to compile one is beneficial to a range of professionals. Whether you’re an individual contributor, a member of the leadership team in a non-accounting role, or an entrepreneur who wears many hats, learning how to create an income statement can provide a deeper understanding of the financial metrics that matter to your business. It can also help improve your financial analysis capabilities.

1- Income

2- New Income

3- Title

4- Income Account

5- Payment Method

6- Bank Account. Amount

7- Transaction Date

8- Upload File

9- Description

10- Submit