The main difference between a VAT and a sales tax is that a sales tax is only paid once: at the initial point of sale. This means only the retail customer pays the sales tax. The VAT is instead collected multiple times during the production of a finished product. Value-added tax (VAT) or goods and services tax (GST), also known as indirect taxes, are consumption taxes levied on any value added to a product.

VAT is Value Added Tax, a consumption tax applied to the purchase price of goods and services. GST stands for Goods and Services Tax and is a consumption tax imposed upon the cost of goods and services. GST and VAT are taxes that share the same characteristics but have different names.

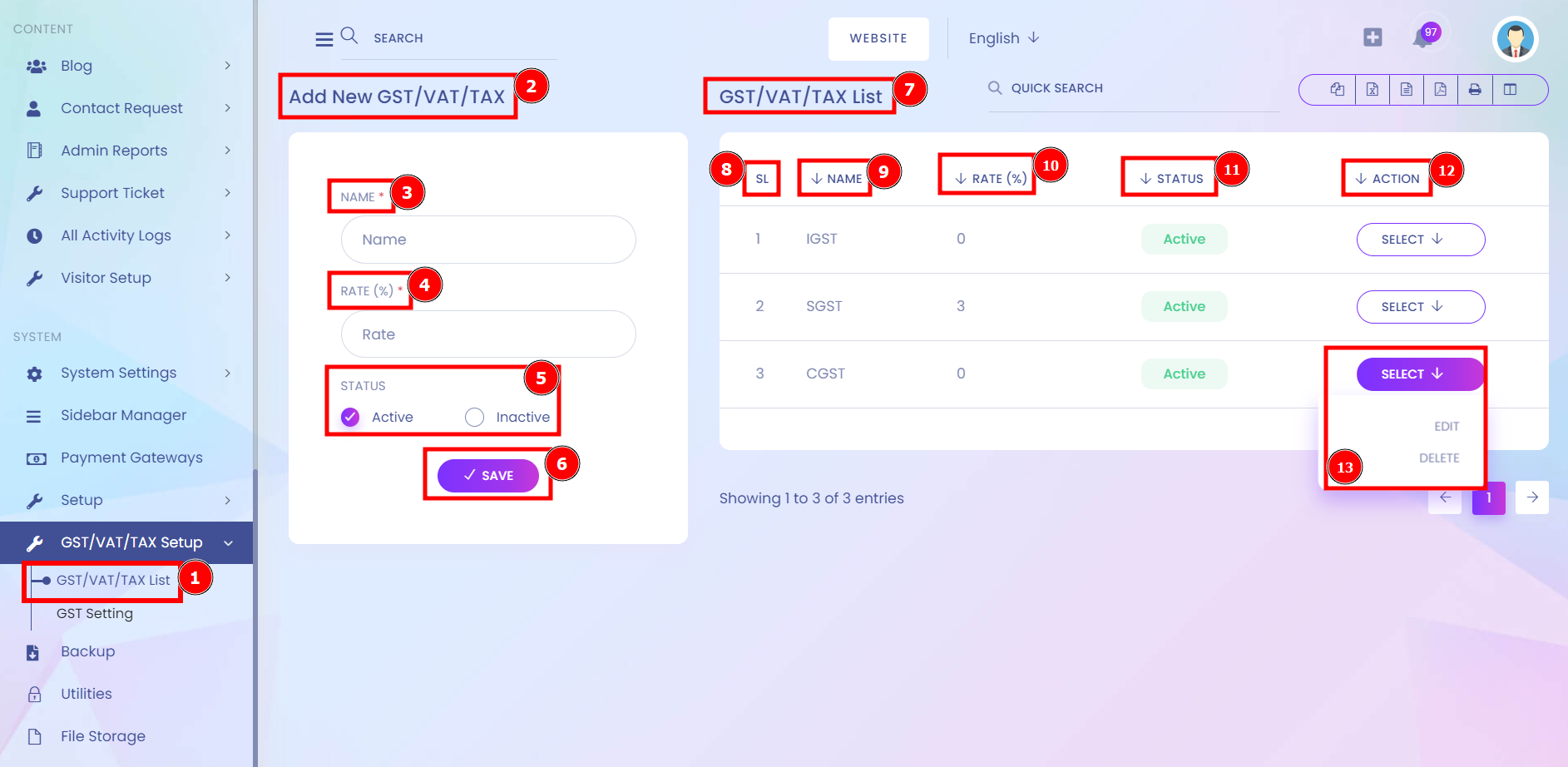

Short Direction: {AmazCart> Dashboard> GST/VAT/TAX List> Add New GST/VAT/TAX> Name> Rate> Status> Save> GST/VAT/TAX all List> SL> Name> Rate> Status> Action> Select.}

You will see all transaction lists when you click on GST/VAT/TAX List. Fill on the Name bar. Bangladesh's sales Tax Rate remained unchanged at 15 % at the maximum and minimum rates.

1- GST/VAT/TAX List

2- Add New GST/VAT/TAX

3- Name

4- Rate

5- Status

6- Save

7- GST/VAT/TAX all List

8- SL means Serial Number.

9- Name

10- Rate

11- Status

12- Action

13- Select For Edit & Delete.

The full form of GST is the Goods and Services Tax. The GST category applies to taxes levied on interstate purchases or supplies of taxable services and imported goods. The Central Government collects GST, which is distributed among all the respective states.

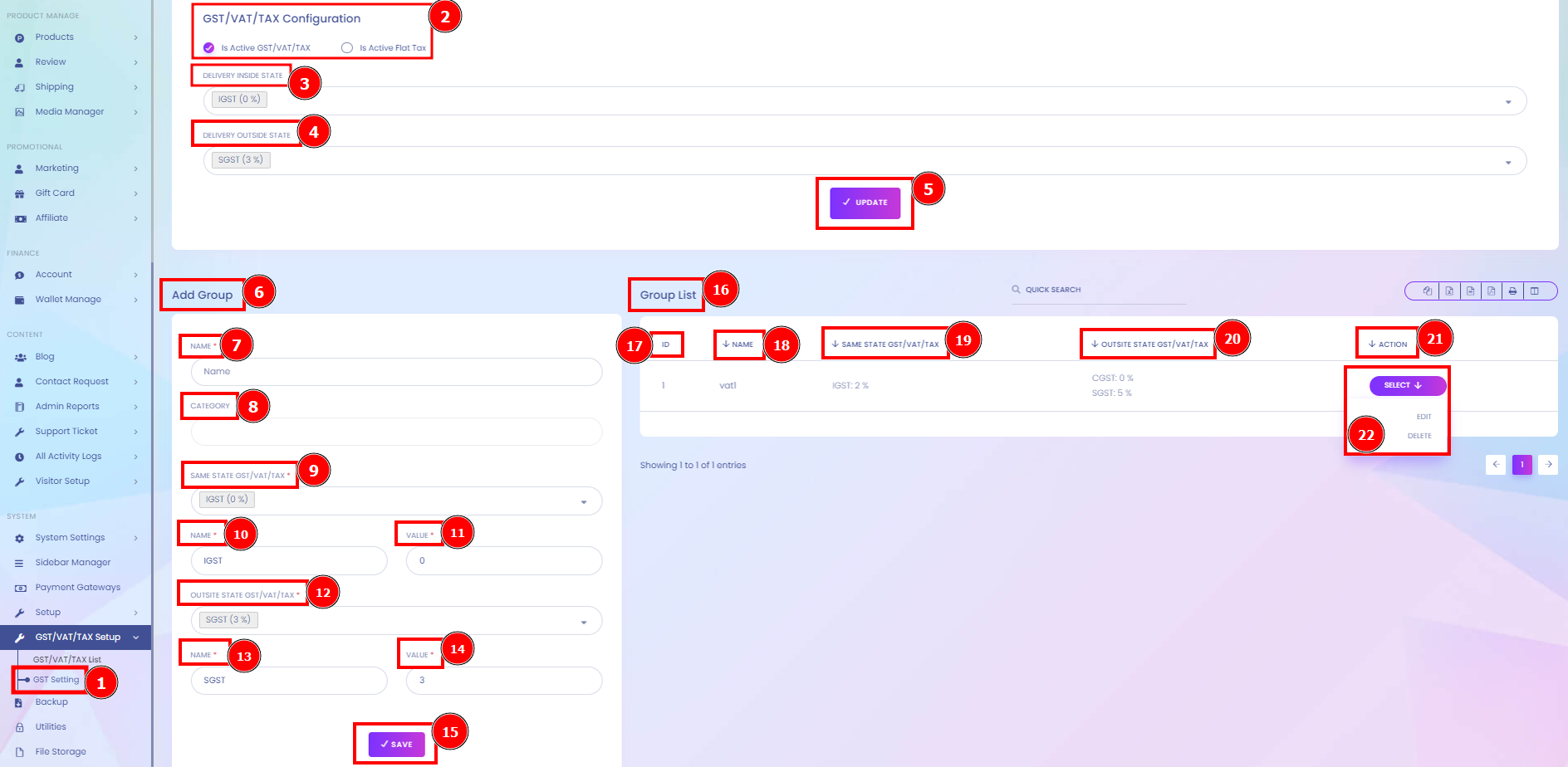

Short Direction: {AmazCart> Dashboard> GST Setting> GST/VAT/TAX Configuration> Delivery Inside State> Delivery Outside State> Update> Add Group> Name> Category> Same State GST/VAT/TAX> Name> Value> Outsite State GST/VAT/TAX> Name> Value> Save> Group List> ID> Name> Same State GST/VAT/TAX> Out Side State GST/VAT/TAX> Action> Select.}

Quickly set up GST Setting rates to be a part of GST/VAT/TAX Configuration, which has to include Delivery Inside the State & Delivery Outside the State.

1- GST Setting

2- GST/VAT/TAX Configuration

3- Delivery Inside the State

4- Delivery Outside the State

5- Update

6- Add Group

7- Name

8- Category

9- Same State GST/VAT/TAX

10- Name

11- Value

12- Outsite State GST/VAT/TAX

13- Name

14- Value

15- Save

16- Group List

17- ID

18- Name

19- Same State GST/VAT/TAX

20- Out Side State GST/VAT/TAX

21- Action

22- Select for Edit or Delete.

---------------------------***----------------------------